Education Sales

Sales strategies and tools for growing your educational product sales

Do you have an educational product to sell?

Then you have come to the right place!

In this article we will go through the best practices of selling:

- different types of educational products

- to different types of educational markets

- through different types of channels

Lets jump right in!

Index

More specifically we will go through the following chapters, click on any to jump to that section:

- Types of Educational Products

- Types of Educational Markets

- B2C educational sales – how to sell to parents

- B2B educational sales – how to sell to schools and universities

- B2B2B educational sales – how to setup a distributor partner program

- B2G educational sales – how to sell to government

- Educational sales summary

1. Types of Educational Products

According to UNESCO, government expenditure on education is about 4.5% of worldwide GDP, and this does not include the private education sector. With such public expenditures, it is understandable that an industry will grow serving this sector with different types of products and services.

The worldwide industry of educational products is exceptionally large and not very consolidated. There exists a plethora of different products that either have an instructional (didactic) purpose or just generic products that just happen to be bought by education providers.

UNESCO has developed the International Standard Clasification of Education (ISCED-F 2013) which is a 96-page document with hundreds of different classifications which is perfect if you need to be very specific, or if you enjoy to geek-out, like I do sometimes.

However, for day to day activities and to easily talk about sales tactics and strategies, I like to separate these product types into the below four different categories. Just keep in mind, educational products often span various of these categories and sometimes its hard to determine which category they best fit into, I suppose nothing is absolute in the world of educational products.

1.1 Instructional content

The first types of instructional products for serving education were pure content plays, essentially textbooks written on specific topics for students to read, learn from and memorize. The main players were the authors and the specialized educational publishers selling into schools and universities.

Many existing publishers started with curriculum and are during the last decade experimenting with digital delivery of textbooks, student exercises, assessment tools etc. coining the term e-learning.

Although the inherent cost structures of e-learning allow for larger margins than printed content (at scale), it has been difficult for many traditional publishers to make this change.

1.2 Instructional Hardware

Instructional hardware has been around since the early part of 1900s and has been used to help teachers and professors to convey complicated subjects in a more applied or hands-on manner.

When I refer to instructional hardware, I mean hardware which comes together with content, instructions, working sheets etc. and has a purpose to facilitate pedagogical delivery of a specific subject field.

Often this instructional hardware has been used to teach natural sciences (such as chemistry, physics, biology), or vocational technology (machinery, textile, automotive, manufacturing, aerospace etc.).

Initially this instructional hardware were demonstrational units run by the teacher or professor in front of the class, but this has developed much more into equipment in which students use their hands-on.

Instructional hardware for younger learners often blends into the field of educational toys, or even “non-instructional hardware”.

1.3 Instructional Software – EdTech

Instructional software, or EdTech, has been growing rapidly during the last decade and had a significant boost during the Covid-19 pandemic when many students have been forced to learn from home.

When I refer to instructional software or EdTech, I mean a software which primary purpose is didactic and facilitates knowledge delivery through a specific process, framework, or tool.

Instructional software or EdTech solutions can be delivered on various devices such as PCs, tablets, mobile phones, VR headsets etc.

In the beginning the absolute majority of leading EdTech players came not from the field of instructional content, nor the field of instructional hardware, but came rather from a technology background to build EdTech products.

This trend is changing when more players from the traditional fields understand the impact of software as a delivery tool, and it becomes easier and cheaper to build EdTech products.

1.4 Non-instructional products and services

Educational institutions spend a lot of resources on different types of products and services which does not have a didactic or instructional purpose. It’s easy to think about it in the following terms:

- Non instructional hardware: such as information technology, furniture, laboratory equipment, workshop equipment, sports materials, playgrounds etc.

- Non instructional software: such as, bookkeeping software, desktop publishing software, authoring software etc.

Any of the above non instructional products or services are a significant part of expenditure of schools, but the reason I like to separate them from instructional tools is that the sales process and the approach differs significantly.

2. Types of Educational Markets

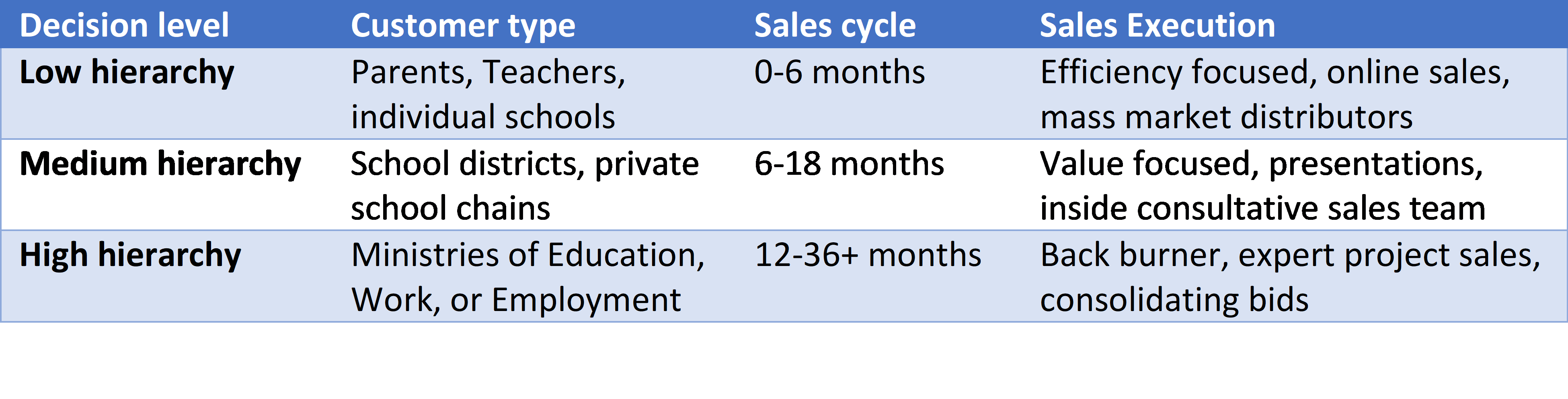

There are many underlying parameters which can make one market different from another, but the main important parameter is the level at which a purchase decision is taken.

2.1 Decisions at lower hierarchy level

In many countries’ educators have a lower discretionary budget for buying supplies and tools for their classrooms. Decisions are typically made directly by the teacher, professor or by the department head.

This discretionary budget is not necessarily high for each teacher but considering the large number of teachers there can be in a market, the whole sum can be considerable.

Such spending patterns of smaller amounts but from larger numbers of customers triggers the need for efficiency in the sales process, online sales, catalog companies and e-commerce platforms can meet this need of low processing costs.

If your product is designed for B2C, then the decision is typically with the parent which also constitutes a low hierarchy level.

2.2 Decisions at medium hierarchy level

In USA schools are typically administered in larger groups called school districts. These school districts range from administrating a handful of schools to hundreds of schools, and they typically have central subject matter specialists supporting educators across their schools.

The same way private chains of schools with tens or hundreds of schools under management often have their central subject matter specialists that make decisions on didactic approaches and the following instructional content, hardware, and software.

The spending patterns that evolve from decisions being made on such hierarchy levels translates to fewer deals, but at a higher value. These higher value deals make it worthwhile for technology providers to setup a strategic, consultative, and corporate sales approach where much more time is spent on each customer and each deal.

2.3 Decisions at a high hierarchy level

In various countries decisions about instructional technology is taken at a ministry level, where educational specialists evaluate and acquire technology for full blown school systems.

This can mean that a country is reinforcing their K-12 school systems, building a totally new network training centers for vocational education, or setting up new college campuses.

Sometimes, but not always, such projects are financed by relief agencies such as USAID, SIDA, Oxfam International etc. or international development financiers such as World Bank, Asian Development Bank, African Development Bank, European Investment Bank etc.

This type of sales use to be referred to as “project sales” and is often the most complicated deals to manage. The sales cycle for large project sales is typically 12-36 months, sometimes longer. The risk is high that your product will not be chosen, but the reward if it is, can be beyond significant.

Most instructional technology providers are often too small to handle such project sales, and therefore consolidate their bids working with specialist project sales companies.

3. B2C educational sales: selling directly to parents

Some educational products are designed to be used outside of the context of formal, school based and compulsory education. These products are typically sold B2C directly to parents, where value propositions, price points, distribution channels, marketing etc. differs significantly from school sales.

The main difference of such a product is often that it is designed to be used in a non-formal environment, without (or with minimal) adult supervision, with an aim for the learner to “self-learn”.

3.1 How to sell educational products to parents

Instructional hardware educational products sold to families rather than schools often have a different value proposition focusing on “fun exploration” or “learning new things”.

Such educational toys and science kits are most often sold in museum boutiques, toy shops, educational supply shops, online marketplaces like amazon and similar.

Any products sold B2C through the above channels are always on the cheaper side since they need to fit into family budgets and the impulsive purchase category. Such price pressure leads to a lower cost product with lower quality parts, and product life cycles.

Companies that aim to introduce products to this category should be aware that they are competing with large toy companies, will have to fight for shelf space at their channel partners, and live on smaller product contribution margins. An approach of designing to price might be useful here.

3.2 How to sell EdTech products to parents

Instructional software – EdTech products which are sold B2C directly to parents often explore a value proposition of “fun exploration” or “learning new things” but might sometimes lean more towards “keeping the kid busy”.

Parents are often concerned (rightly so) of aspects around privacy, screen time and physiological wellbeing. So, this is something that B2C EdTech companies should include in both product designs as well as communications and marketing materials.

Distribution channels such as Google Play store, Apple App store, or the Oculus VR app store all charge a margin of 30% on any app sales, something to consider when thinking about pricing.

4. B2B educational sales: selling products to schools

Educational products are often sold directly by the producer to schools, school districts and school chains. How does this sales process look like? What should you keep in mind while growing your inside sales?

The educational sales process differs between selling hardware products and selling software products, lets start with hardware and later jump into software.

4.1 How to sell educational products to schools and universities

As a reminder, educational hardware products sold to schools always come together with content, instructions, working sheets etc. and has a purpose to facilitate pedagogical impact. Below my process for selling educational hardware products to schools:

4.1.1 Understand your customer

The best way to understand your customer is by interviewing them and by observing the daily jobs and the tasks they perform. Make sure you get out of your office into the real world and actually speak to potential future customers. Try to identify the pains and problems they encounter, as well as the gains and benefits they receive. Both pains and gains can be monetary, emotional, related to risk or other.

If you do not already have deep insights about the customer job, then do not try to imagine and second guess their job, pains and gains, it most surely will never be right.

4.1.2 Create a strong value proposition

Ideally you should understand your customer very well before you develop a value proposition, this could be a hardware or software product or service. Based on your insights about the customer you should develop a value proposition which is very clearly designed to relieve customer pains and create customer gains. This is when you create a strong product – market fit.

If your product or service is already developed, then map out how your newly acquired customer insights relate to your solution and write down where it goes above and beyond the customer needs, as well as where it falls short. This will help in mapping out the next iteration of the product.

4.1.3 Develop clear sales materials

No one wants to buy your product or service; this is the truth of the day. Customers instead want to buy the benefits your product or service will deliver for them; this is an especially important difference.

When you create sales materials, websites, brochures, sales presentations, videos, email templates etc. then make sure you do not focus your communication on the product functionality or the technical specifications, but instead focus on the benefits it delivers for your customers.

If your product or service is clearly helping the customer to save time or money, then lead with this piece of information. If your product or service is specially designed to significantly decrease the risk of something awfully bad happening in their job, then communicate this benefit clearly.

4.1.4 Identify segment and find target customers

Which types of customers is your product specifically designed for, and how do you find them? Can your ideal customer be widely segmented as a “primary school teacher” (education level) or should the target group be narrower “high school biology teacher” (education level + subject matter)?

When you have discovered your target audience, you should identify and build a list of potential customers. This work is mostly about research, structuring and compilation of data. Try to find sources with public information such as government websites, professional organizations, specialist publications, influential bloggers, social media accounts, LinkedIn groups etc.

As an example, in 15 minutes google searching for different phrases around “biology teacher” I could find large lists of high schools, two professional organizations, 250 groups on LinkedIn, various specialist publications, and many influential biology blogs read by biology teachers.

Any target customer information should be meticulously gathered and saved into a CRM (customer relationship management system) to keep tabs on communications, sales stages etc.

4.1.5 First outreach activities

Once you have a large group of contacts of potential customers you should segment them even further depending on what type of outreach communication you want to do (sales vs. marketing vs. business development etc.).

Let us say you have compiled a list of 100 schools for sales outreach in a specific area, do you start by emailing or do you start by calling them? Although some sales gurus will state otherwise, I have not found any evidence that there is a difference in which approach you choose.

Some salespeople prefer to start with a phone call to inquire about who is the correct person to speak to, and that way figuring out whom to direct follow up emails to. The logic is that if you are directing your first emails to the right person (Dear Mr. XXX), you will have a significantly higher response rate than if you don’t (To whom it may concern). It is also easier to follow up with the people via phone to gauge their interest, when you know that you have already sent them a specific and relevant email.

Other salespeople prefer to first email merge anyone (To whom it may concern), and start working immediately on any responses. These salespeople would (rightly so) argue that they will reach traction quicker. The drawback is that they will be working with a database or CRM which data has a lower level of quality than in the initial approach, which in the long run will be harder to leverage for sales. The better quality your database is, the better it will take care of you.

Whichever approach you take, be careful not automate email communication too much. Teachers often take pride in giving personalized attention to their students so don’t treat them as a generalized mass.

Whenever on a call, strive to listen more than you speak. Ask probing questions and make sure you understand the specific needs and challenges of each school that you speak to.

4.1.6 Product presentation

When your outreach activities and ongoing calls or emails have led to an interest from the school to learn more about your products its time for a product presentation, in person or through video call.

What you should strive to accomplish is a situation in which you understand their problems and challenges already beforehand, so that you can personalize your presentation to their situation.

I think there are two key things that needs to be achieved in a product presentation, the first is to create in the customer an eager want to use your products, and the second is to understand your road to a successful sale and implementation.

You should sell by educating rather than presenting, describe different teaching scenarios and how challenges can be met by using your educational product. Help the teacher to see themselves teaching with your product and to become passionate about it. Communicate benefits rather than functionality. Also, be prepared to present research studies which support your claims, focus on quantitative data.

To understand your road to a sale you need to understand the organization, their decision processes, and their purchase behavior. Probe with questions such as; Who else would need to know about our product? By when would you like to implement these tools in your school? How do you normally purchase your products?

Answers to such questions will help you to schedule further presentations with decision makers, or to prepare and send proposals directly. It will also help you to understand when in time the potential sale can happen and how much time you should put into pursuing this specific school.

4.1.7 Proposals and closing

When putting together and sharing a proposal with a warm lead that you hope will become a customer, there are a few important things to consider.

Make it short. There is no need to make a large proposal with all the nitty-gritty details in it. Aim for one to two pages proposal and add a product presentation alongside with it if necessary.

Communicate benefits. Align the customer challenges and needs to the specific benefits which your solution provides, rather than focusing on product functionality.

Optional pricing. If you can, then make sure that you give different price options at different ranges, it makes it easier for the customers to chose something rather than nothing.

Testimonials & Case studies. Show what you can do and that you can deliver upon your promises. Best way is to show information from other customers. Research studies and data proving impact is key.

Be crystal clear. If you know people for whom your proposal or contract might not be easily understood, then there is a large possibility that your lead might not understand it either.

Do not give big surprises. While its often impossible to go through all the intricacies for a sale contract, you need to communicate all the major structures to a purchase contract upfront, before sending the proposal. A few hidden costs in the fine print can get any warm lead to go ice-cold.

When you send your proposal, make sure you also ask for a confirmation that it has been received.

- It will limit the risk of losing time due to difficulties in delivery

- Receiver of the proposal confirms receipt and commits (implicitly) to reviewing it

- Gives reason to call back in a week if you did not get a confirmation yet

When a signed proposal or contract has been received, make sure you are on top of payments and the relevant people internally get involved regarding delivery and implementation.

4.1.8 Follow through, account management

It is not over when the sale has happened, and the product is implemented. You ideally want to create a habit checking in with the customer on a regular basis to check usage and answer questions.

For growing your sales further, it is important to have research studies proving the learning impact of your products. Collect data, good testimonials, online ratings and write up successful case studies. For these things to happen you need to keep a good relationship with the customer, make sure you are there for them when needed.

Another often overlooked sales tactic is to lean on existing customers to introduce you to their friends, colleagues, and professional contacts who might want your product as well.

In case of software SaaS products you have upcoming renewals on a yearly basis, make sure you are not just giving a friendly call two weeks before its time to renew, but that you are there for them throughout the year fully.

4.2 How to sell EdTech products to schools and universities

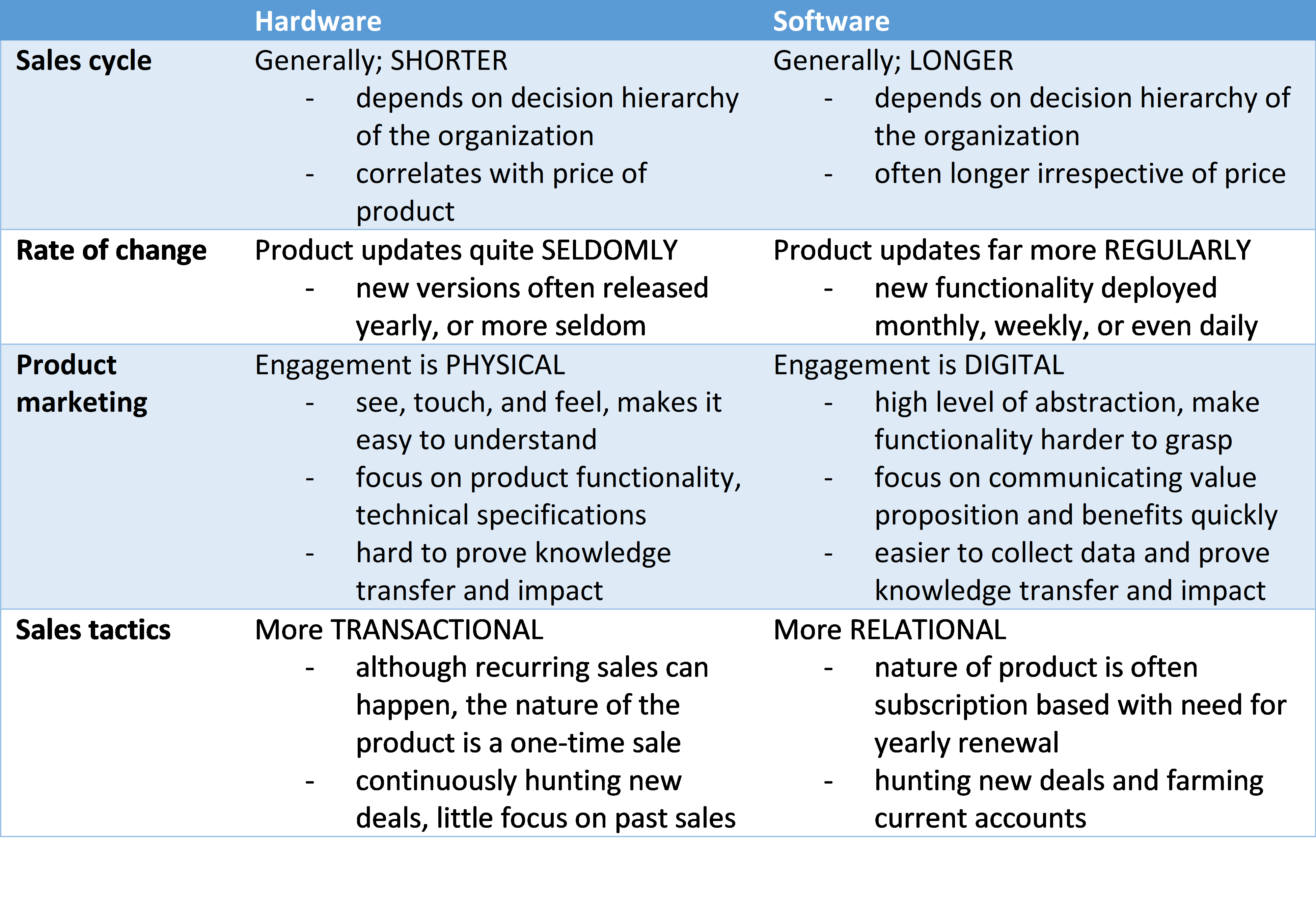

The process of how to sell EdTech to schools does not differ significantly from selling educational hardware to schools. What I mean by this is that the main steps of selling to schools remains the same, even if there are important differences in the sales approach.

First let us look at the similarities between hardware and software sales to schools and universities, later we dig into the differences.

The EdTech sales process

Below we can see the general sales process for selling to schools, irrespective if it is for instructional hardware or instructional software. The way that hardware and software companies choose to approach each step might differ, but the steps themselves do not.

- Understand your customer; understanding the daily job of your customer is important for any company. Identifying regular tasks, and the associated pains and gains is a powerful first step to thoroughly put yourself in the position of your customers.

- Create strong value proposition; once you have a firm understanding of the customer problem, you should design a product or a service which is clearly targeting to reduce customer pains, while increasing customer gains. The final solution could be a hardware product or a software service which is solving the same customer problem in different ways. Alternatively, they could be solving different problems for the same customer, or for different customers.

- Develop clear sales materials; well-developed sales materials are important for both hardware and software solutions. Companies will have to communicate their value proposition clearly, including testimonials, case studies, impact data etc. Software companies because of the simplicity of data collection are often expected to present more data driven proof then companies producing hardware products.

- Identify segment and find target customers; this step in the sales process is crucial and it does not differ, irrespective if you sell hardware or software products to schools and universities.

- First outreach activities; using email, social media messaging, calls etc. is the same for both hardware and software salespeople. The positioning and the communication might differ but otherwise it is the same.

- Product presentation; the way you present your product face to face, either live or through video meetings, can differ between software and a hardware. Since a hardware product is physical it is often easy to grasp how it works and which way to use it, while lack of data gathering makes it harder to prove knowledge transfer and impact. A software product normally has higher levels of abstraction, and is therefore harder to understand, but the ease of collecting data makes it easier to prove knowledge transfer and impact.

- Proposals and closing; hardware proposals often focus on product, technical specifications, price, shipping information etc. Software proposals focus less on the products and more on the benefits, regular improvements, customer support etc. The sales cycle for both hardware and software sales are impacted by the hierarchy of decisions in the organization. Also, the sales cycle of hardware is normally correlational to the price of the product (the more expensive, the longer the cycle), while software sales cycle is just long, irrespective of the price.

- Follow through, account management; it is safe to say that generally the software sales take longer and needs more attention, than the hardware sales. Because of the nature of hardware sales being more transactional, account management is often not as highly regarded. Since software sales rely on yearly renewals it becomes a more relational business where account management is especially important.

I have also written a longer blog post on the importance of educational marketing, where we go through some key differences in marketing instructional hardware vs marketing EdTech.

4.3 Selling Hardware vs. Software Educational products

As you could notice there is a few differences to hardware and software product sales, below we have summarized the major differences.

4.4 General notes on direct education sales

Progressing educational sales

If you are early in figuring out how to commercialize your product, it is a good idea to practice the sales process with smaller potential customers, such as single schools or smaller decentralized school districts. With such smaller customers it is easy to get in contact with the right people and there are minimal barriers to acquiring and testing your product.

Once you have your proven product-market fit, and when you have learnt from smaller sales you should start approaching larger accounts with higher level of hierarchy in the decision process. Here you will notice more bureaucracy in the choice of instructional technology, it is harder to get the necessary buy-in from the correct people, and there is a more complex and administrational-heavy purchase process.

While you learn and as you fine tune the process of selling to larger accounts you will also start getting more information about the potential size of deals, the length of the sales cycle, the probability of closing these deals. Armed with such information it becomes easy to balance the priorities and efforts of your sales team, deciding how to grow, and what to manage manually vs. what to automate.

The 80-20 rule

Most educational entrepreneurs notice patterns in their sales which are similar to Paretos law, which states that 80% of sales come from 20% of customers.

It becomes clear that upselling and high-quality customer support efforts should be targeted where a potential increase in business has the largest impact, that is with the 20% most valuable customers (or those who still are small but has the potential to get there).

In order to help the sales team to focus on the more lucrative accounts, it is important to clear obstacles out of their way. Applying automation for as much as possible of the 80% of customers which impact 20% of revenues is a good idea, both in sales, customer service and other back-end processes.

5. B2B2B educational sales: selling indirectly to schools through channel partners

Setting up a channel partnership program for indirect sales to schools can be a good path to growth. This type of sales is strategic and can take years to build out properly, but if you follow a systematic approach, you can get traction within months.

Simultaneously, if you do not know how to select the right partners or how to train and manage them, you could end up with partners who are not doing what is expected of them. This can easily lose you a year or two in a specific market before you can evaluate their progress and understand that you need to find better alternatives.

I have close to a decade of experience of building partnerships in education sales and in this section, I will give you a framework which has worked well for the companies I have supported to build out their sales channels.

5.1 Define the Value Proposition

A well formulated value proposition is what will make people decide to spend more time learning about your product. I should clearly state what value a customer would receive from the product or services offered by your company.

I like to use the Strategyzer Value Proposition Canvas which is a great tool to create clear and well thought through value propositions based on the customers job, their pain points and the gains they want to achieve.

Once you have created your value proposition it is important to compare it to the market and your competitors to understand how you stand out. The goal is to figure out if you actually offer something unique, or if you should continue developing your value proposition.

When your value proposition is clearly designed it becomes significantly easier for yourself, but also for any channel partners to understand and communicate about your products and services.

5.2 Create a Sales Process

If you do not have a sales process yet it’s important to set one up since this is what will make your sales activities methodic, and ready to be improved.

You should start by defining the customer buying process, this means that you put yourself in the customers shoes with the goal to understand each step the customer goes through from the moment they understand they need a specific product or service (start of buying process), until it has been acquired and implemented (end of buying process).

When you have mapped out the customer buying process you need to change the perspective to your company and to how you want to organize your sales activities. Here you should define each step of the customer buying process as an internal sales stage, from the initial point that the lead gets in contact with your company, until they have become a customer. Make sure all sales stages are as objective as possible and clear for anyone who is involved with sales or marketing activities.

After you have pulled together the different sales stages it is time to identify how your sales activities can support the prospective customer to move through the sales pipeline. This is easiest done through defining the objectives at each sales stage, what actions the salesperson should do to move the customer along through the pipeline, and which tools can support these activities.

Remember that if you sell both directly and indirectly to different channels, then you probably have more than one sales process.

5.3 Define your partners

When you have a clear value proposition and a sales process which involves channel partners it is important to define what type of distribution network you would like to setup.

There are various types of partners and the way you would involve with them depends on which partner strategy you would put in place. This might also differ by geography.

Integrators: are companies that take your product and integrate it into a larger solution (combining hardware, software, and content from different providers), that they market towards the end-customer.

Distributors: buy and sell your product “as is” to resellers, either in a geography (a specific region / country), or in a market vertical (e.g. museum shops or educational shops). Distributors typically specialize, in pooling and aggregating products from many different producers, providing a network of resellers and competing on economies of scale in logistics and warehousing.

Resellers: is the last step before the end-user, these are the companies who sell to schools. Typically, they would have a large network of schools, universities, and training centers to whom they market instructional technology, mainly content, hardware, and software. Educational resellers use a number of different sales tactics in different configurations, such as paper catalogues sent yearly to schools, large e-commerce websites and outside / inside sales teams to interact with their customers.

5.4 Create a Partner Strategy

Which type of partner strategy you should deploy depends on a few different underlying parameters.

5.4.1 Type of Educational Market

As discussed already in the beginning of this blog post, hierarchical decision levels differ very much across continents, countries, and cultures, your partner strategy will have to adapt accordingly.

With low hierarchical decisions your average sales price is low, and you will have many customers, forcing you to maximize reach at highest possible operational efficiency. The best solution is a combination of various web shops and catalog companies.

When there is a high hierarchical level where acquisition decisions are made each sale can be significant, but also requires a lot more work. Very few companies primarily focusing on distribution efficiencies are also well positioned to do project sales, in such environments you will be better off with exclusive distributors that are specialists at tenders and government sales.

5.4.2 Company Stage of Maturity

This is a defining parameter since the amount of sales activity that a sales team can absorb also defines the best channel partner strategy.

For example, if a company is in the very beginnings and wants to get a wide sales-reach it makes sense to start working with distributors to quickly reach a larger number of educational resellers.

If instead a company already has an established sales team, it makes more sense to work directly with the resellers since that will cut one level possibly unnecessary distribution margins.

5.4.3 Company Profitability

Available margins to share with partners is also important to consider before deciding upon the channel strategy.

For example, if you have customers that are price sensitive and your cost of goods sold does not change significantly with scale, then you probably have a limited margin to share with partners.

5.4.4 Growth strategy

Many Venture Capital investors do not assign much importance to unit financials since that can be addressed at a later stage once a startup has reach significant scale. Many investors rather want to see market penetration and quick product adoption, hence pouring in growth funding and subsidizing what would in other situations be considered an “unsustainable” channel strategy.

These are just a few different parameters which influence partner strategies. Many companies evolve their distribution strategy slowly over time, no strategy is forever settled. However, it is advisable to not make continuous changes in the strategy since that will instill a sense of non-stability with your partners.

5.5 Create Internal Support

When a company has decided upon partner strategy, then they will have to start creating support materials, tools, and content for both internal use as well as partner use. Examples of this type of supporting materials would be:

Sales presentations

Product data sheets

Pricing lists

Partner contract

Training content

Reseller support portal

Etc.

5.6 Recruit & Manage Partners

So now you are prepared to start recruiting partners to sell your educational product, how do you get going? This process requires a methodic work and a lot of patience. Managing a partner program is partly science and partly art.

5.6.1 How to find partners

The longer you stay within the educational product industry, the larger of a network you will build. If you are new however, you will have to start with grunt work, all from scratch.

One way is to follow the path of your competitors. Find a product which is similar, or at least sold to the same audience, then check if they list their partners on their website. You can also search for the name of the product and start listing everywhere you can see that it is sold.

Another way is to look at different industry associations, their events and which companies will exhibit on the upcoming trade show, or which companies has exhibited in past trade shows.

5.6.2 Contract negotiations

When you have created yourself a hit-list of potential partners covering the most important markets for you its time to start contacting them. This process is quite like any normal sales process, you contact them with a partner sales deck which explains your program and state that you are interested in discussing partnership.

If you have a good value proposition and an interesting product, you should have conversations going quite quickly. The aim here is to get in place a partner agreement which is stating your terms of doing business together. Many large resellers or distributors have their standard agreements which they put in place with any producers or manufacturers which they represent.

Since these organizations often have a large reach, they can be quite tough in their negotiations regarding pricing, margins, marketing contributions, payment terms, return policies, insurance, incoterms etc. If you do not have experience in negotiating these types of contracts, they will gladly take advantage to get as good of a deal as possible, sometimes even with unfairly advantageous terms.

Remember, if you have a unique and interesting product which educators will want to purchase, there are many ways that you can change the power dynamics so that you are the one who will state the terms of agreement, rather than the distributors or resellers.

5.6.3 Responsibilities and expectations

It is not only important to formalize the commercial agreement with distributors, but you should also clarify what type of responsibilities the partner should have, below a few to consider:

Translations: the educational content, sales and marketing materials of your product is probably developed in English, or another leading world language, but this might very well have to be translated into local language to suit the educators and students.

Marketing: the level of sales success your product will achieve in a market will partly depend on the number and types of marketing activities which your local partner will engage in. This could be anything from presenting your product at local exhibitions, trade shows and in government sales presentations, to including it in their monthly e-newsletters or displaying it on a highly visited e-commerce page.

Customer support: if the content of your product will be in the local language, it is quite common that the customer expects their questions to be answered in the local language as well. Hence it is a good idea to clarify who will manage customer support and make sure the partner has enough product knowledge to provide good customer service as well.

Sales volumes: if a partner gets all the different types of support from your company alongside the business opportunity to sell your products, should you be able to ask for them to reach some minimal sales volumes? This is a common topic in many geographically exclusive partnership agreements.

Agreeing upon minimal sales volumes that satisfy both yourself and the channel partner is a balancing act solved on a case-by-case basis, which depends on many underlying parameters.

What is important for a producer is to find and engage with the right channel partners from the get-go, otherwise there is a risk to lose 1-2-3 years of efforts before there is a decision to change the partner.

5.6.4 Training & Supporting Partners

Keeping partners up to date on the development and improvements of your products and services is an important ongoing effort.

There is a strong correlation between the volumes of sales a channel partner will deliver and the knowledge level they possess of your educational products. Therefore, large companies often rank their channel partners in different ways (e.g., silver, gold, platinum), depending on the knowledge level they have been certified for.

This is why you should create resources, forums, videos and different training materials for your partners to always keep up to date with your developments. Many producers or manufacturers have yearly gatherings, conferences, training sessions etc. for their channel partners.

6. B2G educational sales

Selling educational products to government entities can be hugely rewarding, but it also requires a lot of work and there is high risk that the business will not materialize, this type of sales is called project sales.

The key word here is patience.

6.1 How to sell to government

There are various ways to get the attention of government entities, but it all starts with your value proposition. If you have “me too” product which does the same as any other, then be prepared it will be awfully hard to get the attention of government officials. However, if your product is unique and solves a clearly defined problem in an elegant and efficient manner, then you should try out a few different paths to success.

Start by going through the webpage of your local Ministry of Education or similar relevant entity, read through it carefully and search for “Contracting opportunities” or “Open tenders” or similar. In such sections you can find what the ministry is currently looking to purchase. If your products fit any of these activities, go ahead, submit a bid for the tender.

However, it is exceedingly rare that such opportunities play straight into your hands, most often you will have to create the demand initially, and then later fulfill it.

So how do you create the demand?

You should also aim to have your work, products, and case studies alongside proof of impact to be written up in relevant media, seek out and try to win awards, any quality proof is good.

Try figuring out how you could interact with the relevant government agency and seek the opportunity to present for them. Information is sometimes quite easily accessible through the agency websites. This could be such like presenting your products at a specific trade fair or educational exhibition where government officials will be present.

Another approach is to read up and try to figure out what specific types of problems the government agency is trying to solve, it can sometimes be found in their publicly available documents, such as the strategic work plan for the next five years. If your product is somehow solving any of the problems the government agency is working on, then make sure your value proposition is clearly communicating this and approach them.

Also, many public agencies such as education ministries or school districts have “approved vendor lists” or even “mandated contract lists” in which any suppliers wanting to sell to the government, first will have to be approved and publicly listed on these vendor lists.

Finally, if you work through the right channel partners in some countries, they might have an already established contact, supplying the local government with different types of instructional technology. Essentially, the channel partner could have made it on to the local “approved vendor lists” so choosing the right channel partner can also be a quicker way to large sales, rather than trying to build up the goodwill yourself.

When you or your channel partners have found ways of peaking the interest of government agencies and they have decided that your product is solving a problem they are trying to address, they might initiate a public purchase process, sometimes a tender.

6.2 What is an educational tender?

Regularly educational product sales need to go through a tendering process, which is a way to guarantee best price for taxpayer money. This is almost always the case for public institutions, and sometimes the case for private institutions as well. Often the rules covering tendering procedures are applied on any purchases which price will go over a certain value threshold.

Tendering processes are effectively implemented when the product or service which is acquired has easily comparable alternatives, then the cheapest price often win. However, tendering is not always as effective if the product or service to be acquired is unique, or not easily comparable.

Many institutions both public and private have exceptions for which acquisitions above the value threshold will not go through tenders. When engaging in government sales it is important to understand the expected purchase process and whether your product will have to be managed through a tender process, or if it can be exempt.

6.3 Supplying educational tenders

Be aware, if you have gone through creating demand and managed to meet it by winning a government contract, then be prepared to deliver, no kidding.

Very seldom (read never) does a government purchase provide flexibility in the delivery of the products or services. Instead, often there are heavy penalties if the products are not shipped and arrived at the premises of the government agencies or to the schools within the deadline of delivery.

This means that you might have to quickly scale up (and fund) your production increase to meet the demand initiated by the government tender. Sometimes, this also means that when the delivery of the government contract has ended, you might have an inflated production capacity.

As mentioned earlier, government sales are often called “project-sales” because of their project-based nature. Engaging in such sales can be highly rewarding but also be associated to higher risk.

7. Educational Sales Summary

In this article we have gone through different types of instructional education products (content, hardware, and software / EdTech).

Furthermore, we have clarified the main difference between educational markets (low, medium or high hierarchy in the purchase decision level).

We have covered B2C educational sales, essentially how to sell educational product or EdTech to parents and which things to keep in mind.

After that I described the B2B educational sales process, how to sell to schools and universities, as well as the difference between hardware and software sales.

Later we went through B2B2B educational sales, describing the different steps on how to setup channel partner programs for indirect sales to schools and universities.

Finally, we ended with laying out the main points around B2G educational sales, how to sell your educational products to different government agencies.

If you do find this blog helpful, please link to it, share it with your colleagues and come back later for more articles on how to scale your educational business.

All the best,

Timo

Timo Wohlin-Elkovsky

Timo has extensive experience in the business of instructional technology, specifically in marketing, sales and and business development. Timo has run companies himself as well as worked closely with clients supporting their growth efforts.